Continuing on our previous blog post about the Certified Pick up (CPU) platform and the further digitalisation of the port of Antwerp-Bruges, we will now touch upon the Inbound Release Platform (IRP) that will cover the new Presentation Notification/Temporary Storage (PN/TS) requirements. This all falls under the umbrella of ‘The Way Forward’, which is an initiative of the private port community, Alfaport, to ensure that the port will further automate and digitalise processes as much as possible in-house. Before we elaborate on the new Inbound Release Platform, we first want to refresh the concept of PN/TS and look at the old versus new procedure that will be mandatory as of March 1, 2024 for the maritime sector.

Why PN/TS and what is it?

With the introduction of the Union Customs Code (UCC) in May 2016, the process for entry of goods into the EU changed, as well as the new requirement that all paper-based processes be replaced by digital systems. The digital transformation of the systems is taken up in the Multi-Annual Strategic Plan of the European Commission (MASP), which lays down the deadlines for all the Member States. For PN/TS in the maritime sector, this deadline is March 1, 2024.

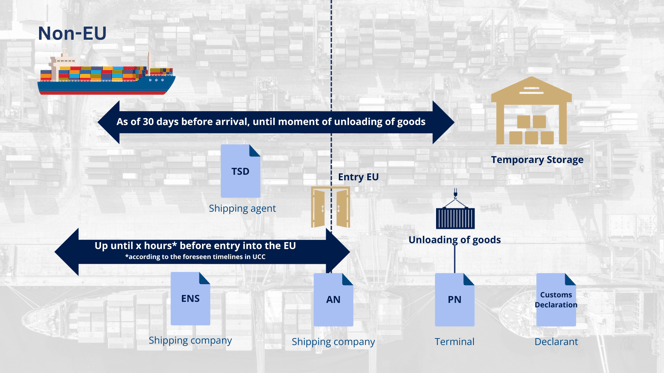

Current process of ‘entry of goods’

Currently, there are four steps when entering goods into the EU via the port of Antwerp-Bruges:

- The process starts with the creation and filing of an Entry Summary Declaration (ENS) at the first port of entry in the EU. Based on the safety and security information, Customs can perform a first risk analysis. The ENS filing needs to be done according to the foreseen timelines in the UCC per type of transport [1].

- Next step is to submit the electronic cargo manifest, better known as the CUSCAR message, to the goods accountability system of Customs, which needs to be done in the port of discharge in Belgium. This CUSCAR message is typically sent a few days before arrival and is currently seen as the temporary storage declaration (TSD).

- The cargo manifest (CUSCAR) is then activated the moment the vessel passes by the buoy of Vlissingen. At that moment, the arrival notification (CUSREP) of the vessel is done by the Port Authority and the goods on the vessel are considered to be under Temporary Storage (TS).

- These goods can stay under TS for 90 days and need to find another customs destination within that time frame.

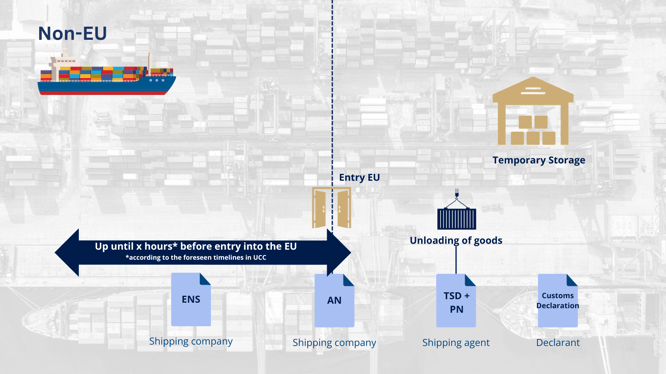

Future process of ‘entry of goods’

As mentioned earlier, with the introduction of the UCC, the process of entry of goods into the EU will change. Below is an overview of the new process at the port of Antwerp-Bruges:

1. Creation and filing of ENS remains an obligation, as this covers the safety and security information. With the implementation of the Import Control System 2 (ICS2), the data elements of the ENS should be submitted to the European System of the Commission, the so called “Common Repository”. Unfortunately, the option to reuse ENS data for the TSD was not retained in Belgium, as this would bring more efficiency.

2. The ENS will be followed by an Arrival Notification sent by the shipping company or ship agent, which is obliged for every transport means entering the EU. Important to note is that this message is not intended to notify the arrival of the goods, but the arrival of the transport means.

These 2 steps are covered by the Import Control System 2 (ICS2) of Customs.

3. Next step is filing the Temporary Storage Declaration. Here we have 2 options:-

- File a pre-lodge TSD. This needs to be done before unloading of the goods. (= standard flow)

- File a combined TSD + PN. This is done at the moment of unloading of the goods.

- File a pre-lodge TSD. This needs to be done before unloading of the goods. (= standard flow)

4. In case of a pre-lodged flow, this will be followed by a Presentation Notification, which will trigger the activation of the TS and is the real presentation of goods to Customs, meaning the actual moment of unloading.

5. As the goods will still be under TS, a customs declaration must be made to discharge the TS.

Having looked at the theoretical approach of the new process of entry of goods into the EU, the question is how will this be organised and how can economic operators make sure they comply with the new regulation on PN/TS?

The Inbound Release Platform is the solution!

As the process of entry of goods into the EU requires multiple actors to file different messages, notifications, and declarations, the Port of Antwerp-Bruges port community saw the necessity of creating a platform where information can be exchanged and re-used, if possible. With that in mind, the Inbound Release Platform (IRP) was born.

What does the Inbound Release Platform cover?

The IRP will function as an intermediate platform between the operators and the PN/TS system of Customs. The platform will support all goods flows (RoRo, Ferry, Container, and Breakbulk) into one process , except for Bulk, where discussions are still ongoing with Customs. Ideally, this goods flow will go into the same process to streamline everything as much as possible.

The IRP will cover the TSD, PN, re-export notification (TRF/REN) for transhipments (also with shunting), control of customs, and the CPU messages. TS administration will also be kept in the IRP system as Customs is providing information back on the customs declarations that take the goods out of TS. As the IRP knows what goes in and what goes out, it can take care of the TS administration, which in turn can steer the CPU.

The basic principle of the platform is explained below:

- Shipping agents will send TSDs and, if required, updates to the TSDs to the IRP. These TSDs need to have reference keys.

- IRP will send the TSDs to Customs.

- Terminals will send discharge messages to the platform. Again, they need to have reference keys.

- Based on the discharge message and the reference key, IRP will look for the relevant TSD and create a PN. This PN is sent to Customs as well. The reason the port community has decided to take up the responsibility of creating a PN in the IRP platform is that the terminal operators will not have the full PN dataset at hand, as it needs to refer to the Movement Reference Number (MRN) of the previous document, for example.

New in the platform: Proof of Union Status

One of the biggest changes with the introduction of PN/TS is that Union goods will also need to be notified to Customs. This is based on the principle set forth in the UCC, which says that all goods should be notified to Customs and all goods will be considered as third-country goods unless you can prove otherwise. This means that a new concept was introduced, namely the Proof of Union Status (POUS). It is important to do the notification correctly, otherwise the Union goods will be taken up in the TS administration and stuck at the terminal.

Process of POUS

The normal process within IRP is that the ship agent will send the TSD with mention of POUS and the terminal will send the discharge message. If a POUS is found when linking the discharge message to the TSD, IRP can take that information and put it into the PN message. This means that the Union goods will not be taken up in the goods administration of Customs and that the process ends there with a release message.

If the PN is sent to Customs without mentioning of POUS, the Union goods will be considered as third-country goods and will be taken up in the TS administration, and thus will need to be taken out via manual process, as there will not be a customs declaration to take them out. This is of course a scenario that both the operators and Customs want to avoid as much as possible as this can have negative financial impacts for the operators (lead time of the goods that are stuck) and will be a burden for Customs, as it unnecessarily increases their work.

In case the ship agent doesn’t have the POUS when filing the TSD, the IRP can look at the UI, where operators can upload their POUS. So, either the POUS is uploaded in the UI or immediately mentioned in the TSD.

Communication with the platform

The platform applies some basic principles that need to be followed when sending in messages or making use of the platform:

- Messages will not be translated or re-mapped to the conform message structures. This means that all incoming messages need to be in the right format according to the customs or IRP specifications.

- All incoming messages will go through a technical validation check.

- IRP will not keep any master data tables, such as EORI numbers. The idea is that this information will be included in the messages each time on a transactional basis.

- TSD and PN will be linked in the IRP via a reference key that needs to be unique for at least 30 days (as the TSD is valid for max. 30 days). If after 30 days no discharge message is received that links to the TSD, the TSD will be deleted from the IRP and also on the Customs side. The following keys apply for each transport type:

- Container: Bill of Lading (BL) number, container number and stay number (optional)

- Breakbulk: BL number + agent EORI + identification number of the colli or number on BL + stay number (optional)

- RoRo: BL number + VIN + stay number (optional)

- Ferry: Bookings number + identification number of the trailer + stay number (optional)

- Only 1 TSD message per unit is recommended to be sent to the IRP.

- The unit is not pre-defined, as the ship agent decides which unit to use, however, the IRP has some recommended units per goods flow:

- Container: 1 container

- Breakbulk: 1 BL number or 1 colli (if identifiable)

- RoRo: 1 vehicle

- Ferry: 1 trailer

They also recommend sending in the TSD messages on the smallest unit possible to make it more transparent.

- The unit can never contain more than 1 BL. Although not recommended, it can contain multiple containers, vehicles, colli, etc.

- The unit will be used further down the process for the release messages and for CPU.

- When Customs wants to perform a control, the entire TSD is blocked, meaning the entire unit.

- IRP will be able to transfer TSD data to the declarants via the existing Import Consignment API, so they can re-use the data for filing an import or transit declaration or any other follow-up customs declaration.

What are the advantages?

We spoke already about what the platform is, what it covers, and how it will work. Now, we’ll address the obvious question: “what’s in it for me?”

As a terminal operator, the advantage lies in the fact that you don’t need to develop a PN message, but only need to send the discharge message to IRP for it to transfer into a PN to Customs. The IRP also offers the TS administration option, meaning that you don’t need to invest in that development as well.

For the ship agents, there will be the automation of the REN messages for transshipments. Also, it will allow them to automate the complex communication of CRN and MRN numbers to the notify parties. The platform will increase efficiency and provide more transparency and security.

At last, for the declaring party, there will b2e the link between the IRP and the Import Consignment API, which helps them get information and re-use it in the declaration filing process. This leads to more transparency, efficiency, and a faster filing process in general.

Conclusion

This blog post is only a summary of the Inbound Release Platform and its functionalities. If you want to learn more about the system, check the Inbound Release Platform Implementation Guide published on 16 October on the Alfaport Voka website. This document contains information about the changed business processes, the functional process flows, a detailed description of the communication between companies and the IRP, and the messages that need to be sent.

How can you prepare yourself?

- Re-align on processes with terminal operators, shipping agents, and your software providers.

- Inform yourself on the upcoming legal changes and the impact on your business.

- Read through the Implementation Guide for more information on processes and communication protocols.

- For ongoing updates, follow Portorium on LinkedIn or contact us directly with immediate questions.

[1] Article 105 – 111 of the Delegated Act of the UCC (2015/2446) - https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32015R2447

Leave a Comment